Have you obtained your Director ID? Make sure you do.

The director identification number (Director ID) regime is now in place with Australia’s newest company directors having to comply first.

Director IDs are a unique 15-digit identifier that a director will apply for once and will keep forever, similar to a tax file number (TFN). A director can only have one director ID and they must use it for all relevant entities.

Background

In the 2020 federal budget, as part of its Digital Business Plan, the government announced the full implementation of the Modernising Business Registers (MBR) Program. This program unifies the Australian Business Register and 31 business registers administered by ASIC into a single platform and introduces the director ID initiative.

Director IDs are intended to prevent false or fraudulent registration of directors, to enable regulators to better trace directors’ relationships with companies, so as to facilitate accountability and traceability. Director IDs will also assist the reduction in phoenixing activities whereby a company is deliberately placed into liquidation, wound up or abandoned to avoid paying its debts (such as superannuation owed to employees, tax owed to the ATO, or debts owed to suppliers/contractors). Under phoenixing, a new company is then started to continue the same business activities…but without the debts.

Who needs to apply?

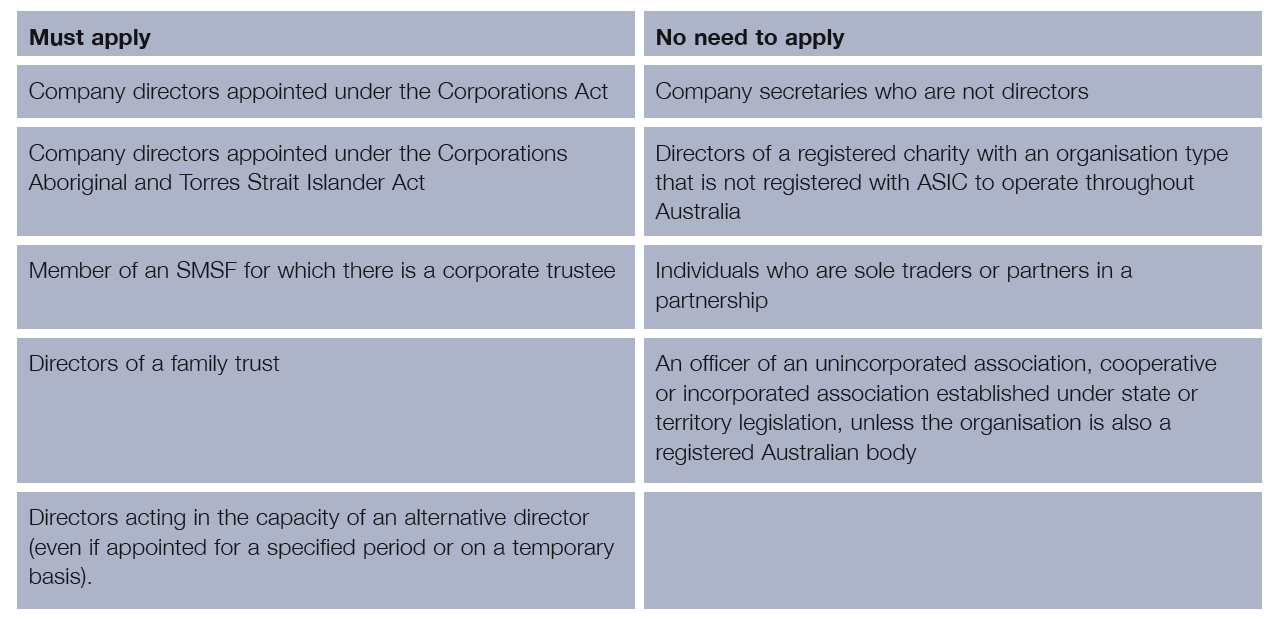

The table on the following page outlines who is and is not required to apply for a director ID. As can be seen, it applies not only to company directors, but to nonbusiness people as well.

When do you need to apply?

The time by which a director ID application must be made depends on the date of appointment as follows:

Therefore, there is some urgency if you are a newly-appointed director from 1 November 2021…you may need to apply for a director ID within 28 days of your appointment.

How do you apply?

Directors will need to apply for a director ID themselves in order to verify their identity. This means that advisers and accountants/tax agents are unable to apply for a director ID on behalf of their director clients.

Directors will need to visit the ABRS website (abrs.gov.au) and click on “Director identification number” near the top of the homepage. Otherwise, directors can scroll down and click on “Apply for your director ID”.

Directors can then follow the three-step process set out on the website:

■ Step 1 – Set-up a myGovID (not the same as myGov)

■ Step 2 – Gather documents required for identification

■ Step 3 – Complete your application

The application process should take less than five minutes and, once complete, the director will instantly receive their director ID. Applicants must provide their TFN, their address as recorded by the ATO, and two basic identification documents. If preferred, directors can also apply for their director ID by telephone or by using paper.

Directors living overseas can still apply online if they can verify their identity with myGovID.

Penalties

The harsh penalties that can be imposed, offer a great incentive to obtain a director ID on time and comply with the ongoing rules. Civil and criminal penalties of up to 60 points ($13,320), or a criminal penalty of up to one year imprisonment can apply where an individual:

■ fails to apply for a director ID when required to do so (see earlier timeframes)

■ intentionally applies for more than one director ID

■ provides a false director ID, or

■ is actively contravening one of the above offences.

Directors of an SMSF corporate trustee who fail to obtain a director ID may be forced to step down as a trustee and potentially leave the fund.

Take-home messages

■ All directors should apply for their director ID well before the relevant deadline.

■ Directors should also take care when applying for their director ID. They must only apply via the abrs.gov.au website as it is a secure site that will keep your information safe.