Employee Allowances

Do your employees travel for work? The ATO has issued new guidance to help employers determine whether to pay employees a travel allowance or a living-away-from-home allowance (LAFHA).

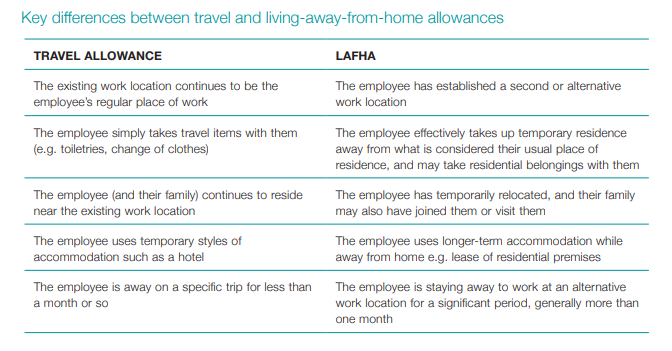

There are some key differences between the treatment of the two types of payments:

■ A travel allowance will generally need to be included in your employee’s assessable income and may need to have tax withheld from it. It covers accommodation, food, drink or incidental expenses an employee incurs when they stay away from their home overnight or for a short period to carry out their duties. It’s generally deductible to the employer.

■ A LAFHA payment you provide to your employees may be considered a LAFHA fringe benefit. Where this is the case, it will need to be reported in your annual fringe benefits tax (FBT) return. LAFHAs are paid to compensate an employee for additional living expenses they incur if they are required to live away from home for an extended period for work purposes. In certain circumstances, such payments may be exempt from FBT for the employer and not taxable to the employee!

LAFHAs are paid where an employee has moved and taken up temporary residence away from his or her usual place of residence so as to be able to carry out their job at the new but temporary workplace. The employee has a clear intention/expectation of returning home on the cessation of work at the temporary location (in this sense, the employee is absent for a limited/finite period of time).

On the other hand, a travel allowance is paid for specific trips because the employee is travelling in the course of performing their employment duties but has not temporarily relocated as a LAFHA recipient would. The existing work location continues to be the employee’s regular place of work. In travelling away from home, the employee simply takes travel items (such as toiletries and a few changes of clothes). Employees receiving a travel allowance will also typically use temporary styles of accommodation such as hotels.

A travel allowance provided by an employer is not taxed under the FBT regime but may be taxed under the PAYG withholding regime as a supplement to salary and wages. The ATO publishes guidelines each year on what it considers to be reasonable amounts for a travelling employee, and take the following factors into consideration:

■ destination of travel (broken down into metropolitan cities, country centres within Australia and international countries)

■ accommodation

■ meals

■ other incidentals

■ employee annual salary (in ranges)

■ specific rates for truck drivers.

Countries other than Australia are split into “cost groups”, with each determining the reasonable amount of the daily allowance. These are determined based on the cost of living in that country and then numbered between cost groups one to six. Cost group one has the lowest daily allowance and cost group six has the highest.

The reasonable amounts are intended to apply to each full day of travel covered by the travel allowance, with no apportionment required for the first and last day of travel.

Where the employer has paid the employee less than the ATO-determined reasonable amount, then the employer is not obligated to withhold from the allowance nor does the employer have to include the allowance on the employee’s PAYG income statement.

Key differences between the two types of payments are captured in the table on the following page.

Ultimately, allowances for travel are a handy employee retention tool – helping them cover the costs of work-related expenses they may incur while travelling on or relocating for business. Speak with your advisor if you are uncertain about their taxation treatment.