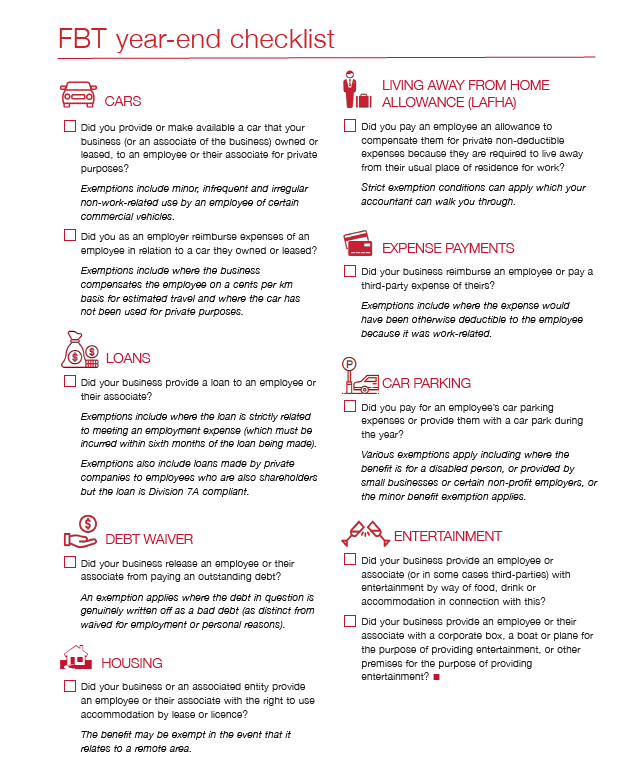

FBT year-end checklist

March 31 marks the end of the 2021/2022 fringe benefits tax (FBT) year which commenced 1 April 2021. It’s time now for employers and their advisors to turn their attention to instances where non-cash benefits have been provided to employees, and also where private expenses have been paid on their behalf.

Although it will generally fall to your accountant to prepare the FBT return, from your software file or other records, all of the instances where you have provided employees and/or their associates (e.g. spouse) with potential fringe benefit may not always be apparent to them. To assist you in bringing these potential benefits to the attention of your accountant, following is a general checklist (non-exhaustive).