New Reporting Arrangements for SMSFs from 1st July 2023

From 1 July 2023, trustees and directors of SMSFs must report certain events that affect their members transfer balance account quarterly. These events must be reported by lodging a ‘transfer balance account report’ (TBAR) no later than 28 days after the end of the quarter in which they occur.

The purpose of this change is to streamline the reporting process and bring all SMSFs under a single reporting framework. This means there will no longer be an ‘annual reporter’ option.

What is a transfer balance account and a TBAR event?

The introduction of a transfer balance cap (TBC) from July 2017 introduced a limit on how much an individual could transfer from their superannuation accumulation account into a retirement phase pension. In order to track an individual’s use of their TBC, a ‘transfer balance account’ (TBA) is created to record necessary transactions from the time an individual first commences a retirement phase pension.

Importantly, a TBAR is only required when a member has an event which affects their TBA. The most common reporting events include:

■ Commencement of a pension

■ Lump sum withdrawals from a pension account

■ Commencement of a death benefit pension.

For many SMSFs, the members will have only one or two TBAR events in their lifetime.

Other events that do not affect a member’s TBA and therefore do not need to be reported include:

■ Pension payments

■ Investment earnings or losses

■ When an income stream ceases because the capital has been depleted

■ Death of a member.

Changes from 1 July 2023

From 2023/24 onwards:

■ A member’s total superannuation balance will no longer be relevant in determining whether an SMSF reports on a quarterly or annual basis, and

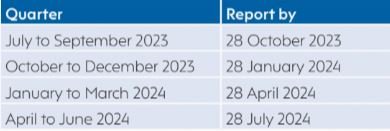

■ All SMSFs must lodge a TBAR within 28 days after the end of the quarter in which the TBC event has occurred (ie, by 28 January, 28 April, 28 July, and 28 October).

The new TBAR timeframes will therefore be due from1 July 2023 as follows:

This means that SMSFs that have previously been permitted to lodge a TBAR on an annual basis will no longer be permitted to do so from 1 July 2023.However, the obligation for SMSFs to report earlier will remain in cases where a fund must respond to a pension excess transfer balance determination or a commutation authority from the ATO.

Action items for SMSF trustees

For those SMSFs that already report on a quarterly basis, there will be no change to the reporting frequency for TBAR events. The changes impact SMSFs that are annual reporters only.

Note, if you’re currently lodging your TBAR annually at the same time as your SMSF annual return, you will need to report all events that occurred in the2023 financial year by 28 October 2023.

Should you have any questions on your TBAR reporting obligations, please contact us today as we can help you prepare for these upcoming changes.